How to set rent at your investment property

Knowing how to set rent at your investment property correctly is critical for your success and one of the most important functions that we have as property managers. It is our obligation to our clients to maximize their return on investment. Our vital responsibility is to ensure that the property is consistently generating market level rental income. Below is a rough description of the process we use and shows how to set rent at your investment property.

First of all, higher set rent doesn’t necessarily mean higher income. If we set the rent too high, nobody will want to live in the property and the situation will result in long vacancy, and therefore loss of income. If we set the rent too low, we will be able to identify the problem by extremely high demand – everybody is interested in the property. Renting a property at too low price results in a lost opportunity, and therefore a loss of income.

We are thriving to set the rent right at the market level. A sign of a well set rent is about 5 applications within a week of posting. We will use a combination of the following factors when setting the rent level: property class, current market rent data, current market trends, current tenant (if any) and our experience.

Determine the property classification

Is this an A, B, C or D class property? There are hundreds of articles on the internet written about this topic, here is a brief description.

A – Built or remodeled in the last few years, has luxury finishes, and is in a great area. Maintenance costs are usually very low due to the age of the property.

B – Built or remodeled in the past 20 years in a good area and has builder-grade finishes. Maintenance and CapEx are higher due to the age of the property. Eventual mechanical upgrades needed

C – The age of the property becomes a gray area. The area needs to be strongly evaluated. Generally, maintenance is higher and the property is in desperate need of updating and repair, including mechanical, roof, and other structural components.

D – This class is oftentimes called the “war zone.” The neighborhood is older or in a serious stage of neglect.

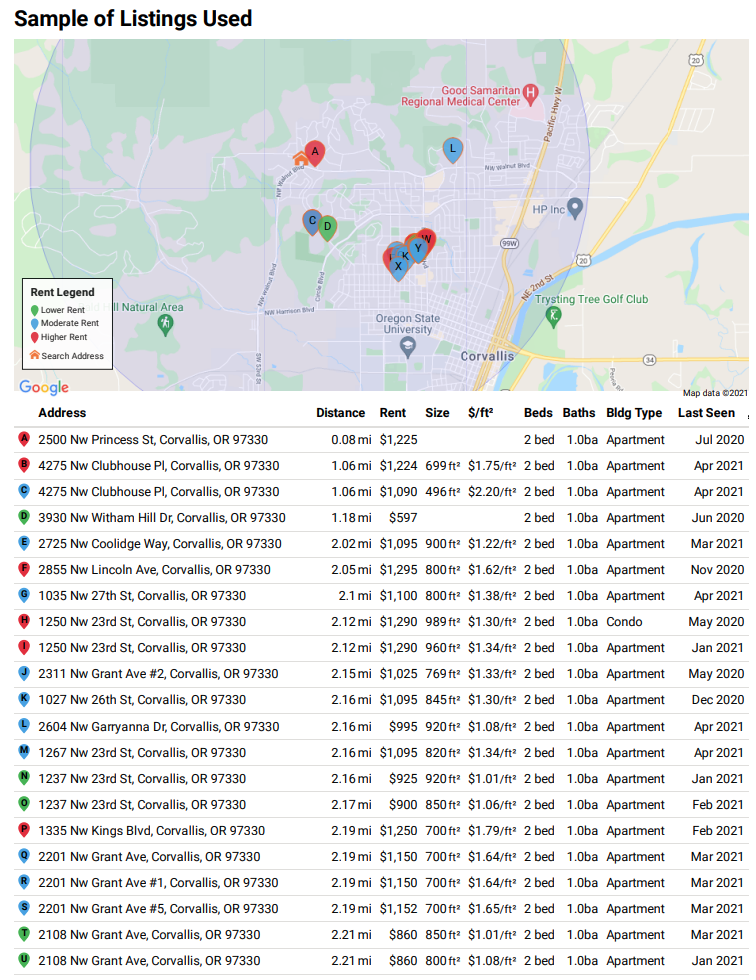

Current market data

Run a report on market rents in the area. To start & provide a really rough generalization, the best properties will be renting for ranges in the 75th – 95th percentile, average properties will hover around the median and properties with lots of deferred maintenance will rent for prices around the 25th percentile. Go over a list of comps and compare the property with the most similar properties.

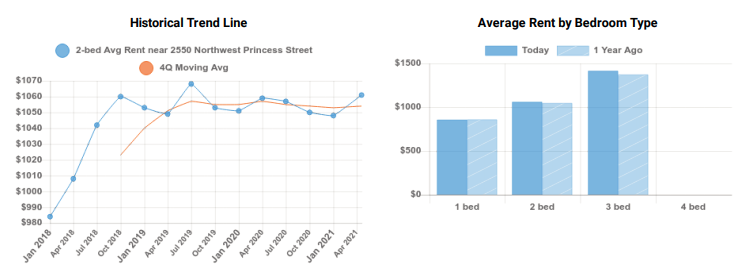

Current market trends

Analyze the current demand for similar properties – is it rising, steady or falling? Can you afford to go higher or will you have troubles finding tenants? Is there a shortage of housing or do you see a lot of “FOR RENT” yard signs around. Think about the data.

Current tenants

If you have a current tenant, evaluate if it is worth incentivizing to keep them in the unit and raising rent just nominally or not at all, or bring the rent levels to market if they are not there. Keep in mind the maximum amount you can raise rent every 12 months (7% + CPI), 9.2% in Oregon in 2021.

Keeping current tenants in will save money on costly turnovers (a few hundred to thousands of dollars), raising rent will bring you additional revenue. Run both scenarios side by side to make an informed decision.

Experience

Factor in what you know – is this particular unit easy to rent? Does it have any amenities, bonuses, specifics that would make it more or less attractive to the tenants. Is it in a desirable location? Did you rent a very similar unit in the last month? Factor your experience in the rent amount.

Set the rent

As a general rule of thumb, it is better to aim for higher rent and reduce the rent if the demand is not sufficient. If you decide to go the other way, you will end up with below-the-market rent levels or a lot of communication in your hands with eager applicants.

How to set rent at your investment property is certainly one of the most important things you need to know if you own a rental. If you have any questions or need assistance, feel free to reach out to us.

Owner of LongStreet Property Management